Polymarket Team Member Accuses Kalshi of Inflating Esports Trading Volume

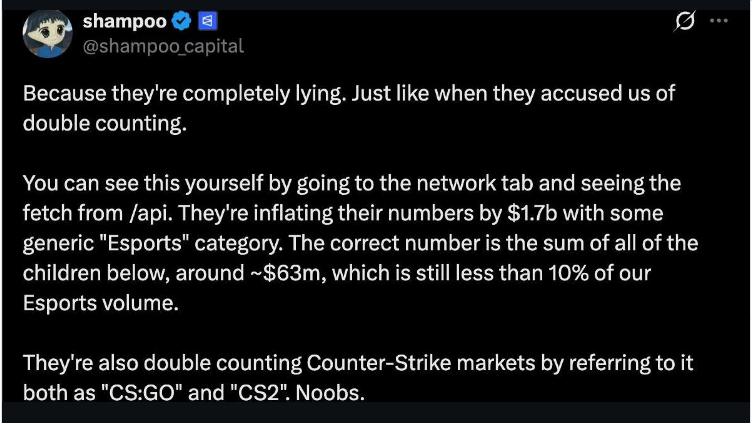

A Polymarket team member has accused rival prediction market platform Kalshi of vastly inflating its esports trading volumes.

In a now-deleted post on X, the user shampoo claimed Kalshi has inflated its esports volume to as much as $1.7 billion, when the true figure should be around $63 million.

Shampoo’s bio simply says “esports @Polymarket”.

The user argued that Kalshi is “inflating their numbers by $1.7b with some generic “Esports” category. The correct number is the sum of all of the children below, around ~$63m, which is still less than 10% of our Esports volume.”

They added that Kalshi is double-counting Counter-Strike markets by referring to it both as “CS:GO” and “CS2”.

Both Kalshi and Polymarket have been expanding their esports markets, and although it may be difficult to tell the actual trading volumes on markets, it is clear that many users are profiting from wagering on events.

Polymarket Previously Accused Of Inflating Figures

The accusation comes after Polymarket also faced claims that it is overestimating its trading volume. The Polymarket team member says these accusations were lies spread by Kalshi.

Matt Huang, CEO of investor firm Paradigm, said a bug in Polymarket’s system means its volume is being double-counted.

Huang shared a post from research partner Storm Slivkoff claiming that “every major dashboard has been double-counting Polymarket volume.”

The post came just a week after Paradigm led a funding round of $1 billion in Kalshi, valuing the company at $11 billion.

Primo Data, an X account dedicated to data reporting at Polymarket, responded that the claims are inaccurate. The account said that Polymarket does not double-count data, but uses the same reporting methods as Kalshi.

In a post on X, they explained, “The primary dashboards that show both Polymarket & Kalshi show notional volume from the taker — which is consistent with one another and, again, no double counting.”

Slivkoff emphasized the issue affects third-party analytics rather than Polymarket’s internal reporting, replying, “This post isn’t about Polymarket’s website, it’s about the common dashboards that people use for tracking Polymarket volume.”

Researchers Also Claim Volume Is Inflated

Last year, researchers at Columbia University published a paper titled “Network-Based Detection of Wash Trading”.

The authors also did not suggest that Polymarket itself was responsible for artificially inflating numbers, but said elements of the exchange’s crypto-based structure made it possible.

The researchers estimated that “transaction patterns indicative of wash trading began to trend upward in July 2024, peaking at nearly 60 percent of volume in December 2024.” This fell to around 5% in April last year, before rising again to 20% by early October 2025.

In total, Polymarket reports trading volume of $22.2 billion, with $16.2 billion of that in the last year. Kalshi, meanwhile, reports over $41 billion in all-time volume, with over $39 billion of that in the last twelve months.

Nick Preszler of Melee Markets argues that a better system of tracking volume is needed. In a post on X, he gave an example of the problem, stating, “(I)f a user buys $10 worth of contracts at .1c each, they are risking $10, but get credited for $10,000 of volume because they have purchased 10,000 contracts.”

While most that have claimed volumes are inflated say the companies are not deliberately manipulating the figures, the Polymarket team member claims Kalshi is lying on purpose when it comes to its esports markets. Kalshi has not responded to the accusations.