Global Esports Betting Statistics 2025: Market Size, Trends & Data Explained

- The esports betting market is expected to reach $2.8 billion in 2025, driven by rising user numbers, higher spending, and major global events.

- Europe dominates the market, while LATAM, North America, and Oceania show distinct growth patterns shaped by regulation and fan culture.

- Most betting activity centers on CS2, LoL, VALORANT, Dota 2, and CoD, with Gen Z and Millennials making up the majority of bettors.

Global esports betting statistics help explain a market that’s growing quickly, but the data can often feel messy to navigate. Much of it is spread across different reports, each using a different methodology to describe figures, creating gaps that make it difficult for readers to compare trends.

This guide brings together esports betting statistics from 2024 and 2025. It covers global market size, regional patterns, game-level betting activity, revenue projections, and provides simple explanations of statistical terms, such as “handle” and “betting revenue.”

- 1. What Is The Esports Betting Market Size In 2025?

- 2. How Fast Is The Esports Betting Market Growing? (Growth Rate & CAGR Explained)

- 3. Which Regions Dominate Global Esports Betting Statistics?

- Europe

- Latin America (LATAM)

- North America

- Oceania

- 4. Why Do Regional Esports Betting Growth Rates Differ?

- 5. What Games Drive The Most Esports Betting Revenue?

- Counter-Strike 2

- League of Legends

- Dota 2

- VALORANT

- Call of Duty

- How Bettor Demographics Shape Esports Betting Trends

- 6. How To Interpret Esports Betting Statistics

- Definition of Key Esports Betting Market Metrics

- How To Interpret Esports Betting Market Projections

- Understanding Data Sources

- 7. Is Esports Betting Profitable?

- For Operators

- For Bettors

- 8. What Are The Global Esports Betting Trends For 2025?

- Growth Shaped By Higher Overall Activity

- Regions Developing In Their Own Way

- Few Games Drive Most Activity

- Growing Interest Among Younger Adults

- 9. FAQs

- 10. References

What Is The Esports Betting Market Size In 2025?

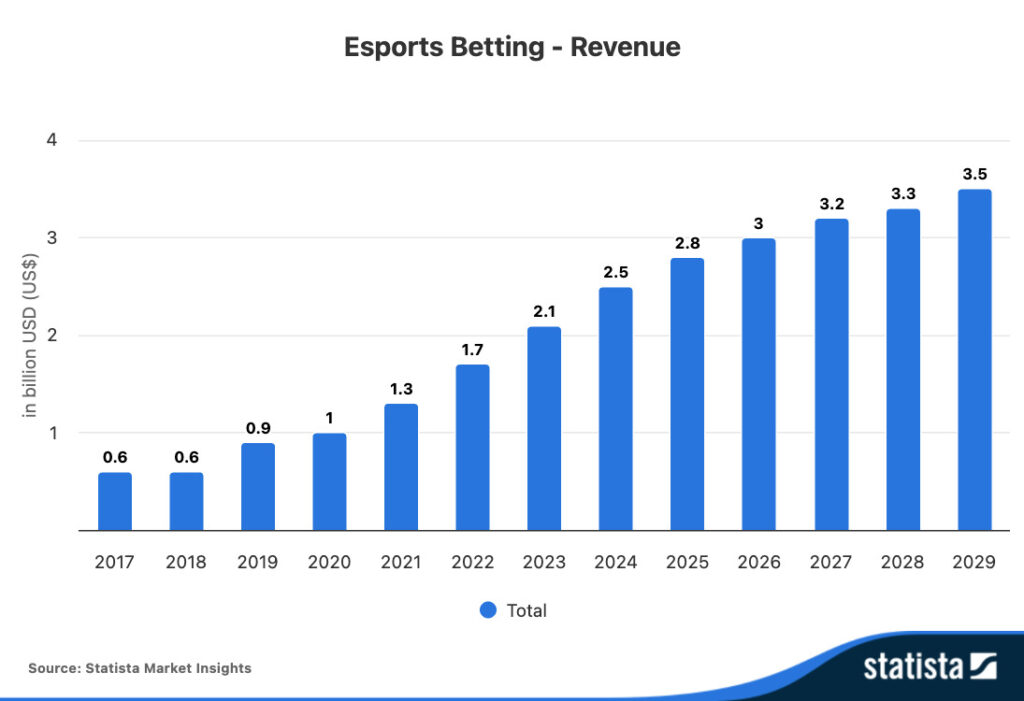

The esports betting market size in 2025 is projected to be around $2.8 billion in revenue (Statista Market Insights, 2024a). This number represents the amount of money earned by sportsbooks through esports bets across major global events.

Here are some key numbers that help round out the current market outlook:

- Market expansion: Statista projects esports betting revenue to hit $3.5 billion by 2029.

- Yearly change: Revenue is estimated to have grown by 12% in 2025 compared to 2024.

When esports betting data is compared with the broader sports betting market, a clearer picture emerges: Traditional sports wagering accounts for a far larger share of global gambling revenue, but its growth rate is more modest (Statista Market Insights, 2024b).

Here are some figures on the wider sports betting market:

- Total market size: Sports betting generated an estimated $77.2 billion in 2025, according to Statista.

- Market expansion: Revenue is projected to rise to $94.9 billion by 2029.

- Yearly change: Market revenue in 2025 is estimated to have grown by 9% compared to 2024.

These figures firmly position global esports betting statistics for 2025 within a wider gambling context.

How Fast Is The Esports Betting Market Growing? (Growth Rate & CAGR Explained)

Recent esports betting growth statistics point to steady growth over the next few years. According to Statista (2024a), revenue is expected to grow at an annual rate of 5.5% from 2025 to 2029.

User spending and access also play a role in shaping the outlook. Here are some key growth drivers:

- Higher reach: The number of esports bettors climbs each year, rising to an estimated 80.2 million in 2025 and trending toward 95.2 million by 2029.

- Rising revenue per user: The average revenue per user in 2025 is estimated to have reached $34.90. In 2029, this is expected to grow to $36.40.

Major events, such as the League of Legends and Mobile Legends: Bang Bang World Championships—some of the most-viewed esports tournaments of all time—also contribute to market growth.

These games (and many others) host huge competitions that draw global audiences, keeping fans betting steadily during peak seasons.

Which Regions Dominate Global Esports Betting Statistics?

By assessing worldwide esports betting statistics, it’s clear that there are striking differences across regions. The figures below outline how regional esports betting statistics varied in 2025.

Europe

Europe remained the largest market segment in the first half of 2025.

- Europe held 74% of the total amount of money wagered on esports (the betting handle) across global markets (Sharpr, H1 2025).

- It also made up 73% of the total number of individual bets placed worldwide (the global bet count).

- This region is now focusing on enhancing the quality of the betting experience (Odin.gg, 2025).

Latin America (LATAM)

In the first half of 2025, LATAM was the second-largest part of the market, especially after its strong rise in activity.

- LATAM made up 10% of the global betting handle (Sharpr, H1 2025).

- In fact, its global betting handle grew by 27% in H1 2025 compared to H1 2024.

- Bettors made up 21% of the global bet count.

North America

North America made up a smaller share of the market in the first half of 2025. Still, the region has strong loyalty toward specific games.

- The share of the global betting handle reached 4% (Sharpr, H1 2025).

- However, Call of Duty accounted for 12% of the entire North American betting handle, far higher than in other regions.

- VALORANT comprised 12% of the North American handle—almost double the share seen elsewhere.

Oceania

Oceania shows a clear betting pattern that stands out in the esports market, creating a profile built on a higher number of bets but with low value behind them.

- Oceania held 3% of the global betting handle in the first half of 2025 (Sharpr, H1 2025).

- However, the region made up 10% of the total number of bets placed worldwide.

- Oceania contributed 23% of the global Dota 2 handle, demonstrating the huge interest these viewers had in this specific title.

Why Do Regional Esports Betting Growth Rates Differ?

Esports gambling statistics show that regional esports betting growth moves at different speeds. Here is how market factors shaped activity in 2025:

- Regulation: Strict or unclear regulations make it more challenging for operators to build strong markets. For example, North America’s global handle dropped in H1 2025 largely due to slow regulatory progress (Sharpr, H1 2025).

- Fan culture: Regions with strong followings for certain games often record higher activity, even when their market size is smaller. Oceania made up a small proportion of the global betting handle in H1 2025, yet contributed a significant portion of the global Dota 2 handle (Sharpr, H1 2025).

- Market maturity: Mature regions already have stable demand and a deep pool of active bettors, like Europe, so they focus more on differentiation (Sharpr, H1 2025; Odin.gg, 2025).

- Demographics: Younger bettors tend to place bets more often and engage with more titles, which increases activity in regions with a strong Gen Z base. For example, Gen Z made up 44% of all esports bets in 2024, surpassing Millennials at 36% (Sharpr, 2024).

What Games Drive The Most Esports Betting Revenue?

The games that bring in the most esports betting revenue in 2025 come from a small group of titles that have steady calendars and active fan communities.

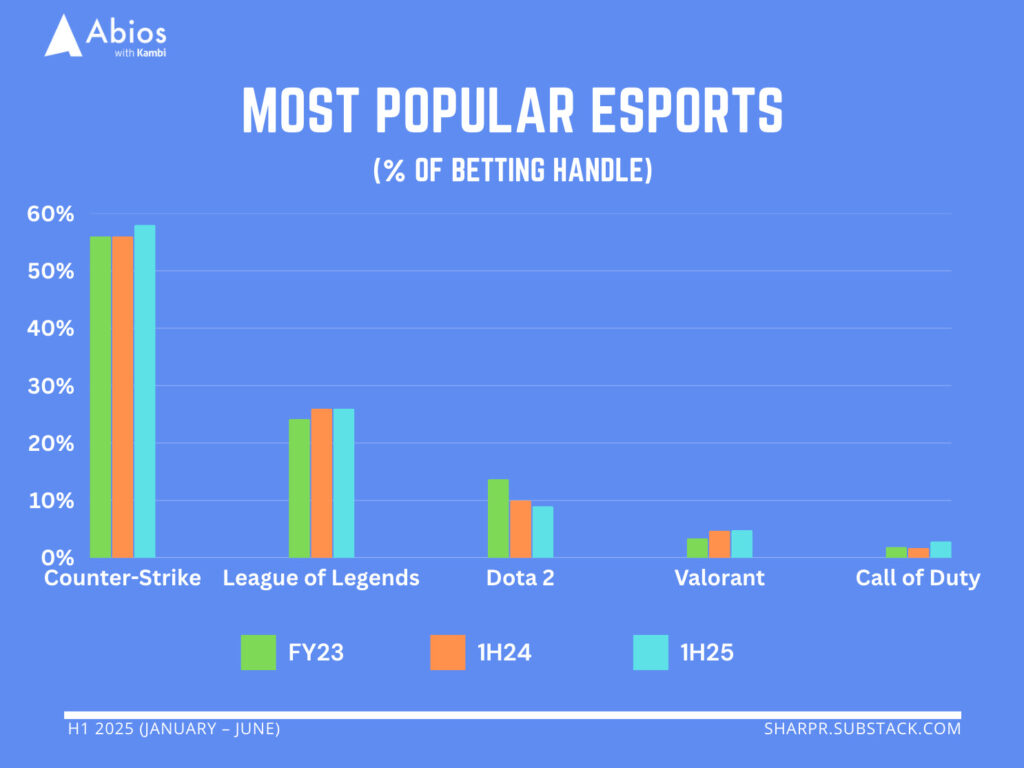

Current esports betting statistics by game show that Counter-Strike 2 (CS2), League of Legends (LoL), VALORANT, Dota 2, and Call of Duty (CoD) account for the largest share of the market.

Counter-Strike 2

CS2 plays the biggest role in esports betting revenue.

- It held 57% of the global betting handle in the first half of 2025 (Sharpr, H1 2025).

- In the third quarter of 2025, CS2 recorded a 27% increase in total money wagered and a 55% increase in profit compared with the third quarter of 2024 (Data Bet, 2025).

- CS2 had the highest number of tracked events and consistent match coverage, which maintained steady betting activity (Sharpr, H1 2025).

League of Legends

LoL continues to perform well across regions.

- It held 26% of the global betting handle in the first half of 2025 (Sharpr, H1 2025).

- In the third quarter of 2025, LoL experienced a 290% increase in total money wagered compared to the third quarter of 2024 (Data Bet, 2025).

- LoL also had many events, with massive global attention on the Mid-Season Invitational and Worlds, events that typically create strong peaks in betting activity (Sharpr, H1 2025).

Dota 2

Dota 2 still holds an important place in the market, ranking third.

- In the first half of 2025, it accounted for 9% of the global handle (Sharpr, H1 2025).

- However, it’s on a downward trend: its share of the betting handle stood at 10% in the first half of 2024, and 14% in 2023.

- The International viewership has also declined in recent years, which is why betting markets have been impacted (Sharpr, 2024).

VALORANT

Interest in betting on VALORANT has been climbing.

- It reached 5% of the global betting handle in the first half of 2025 (Sharpr, H1 2025).

- In fact, its share of the betting handle grew from 3% in 2023 to 5% in 2024 (Sharpr, 2024).

- A wider event schedule, supported by the VALORANT Champions Tour stages across regions, encouraged more betting activity (Sharpr, H1 2025).

Call of Duty

CoD might not be a global powerhouse, but it’s incredibly popular in North America.

- It reached 3% of the global betting handle in the first half of 2025 (Sharpr, H1 2025).

- This is up from 2% in the first half of 2024.

- In North America, it made up 12% of the regional handle.

- CoD’s rise in betting came from better-performing Majors and the Call of Duty League’s city-based teams, which helped build steady interest.

How Bettor Demographics Shape Esports Betting Trends

The latest esports stats also show clear links between age and betting activity, with younger adults playing a major role in shaping esports betting demand.

- Gen Z made up 44% of esports bets in 2024, rising from 36% in 2023 (Sharpr, 2024).

- Meanwhile, Millennials made up 43% of betting activity in 2024.

- Gen X held a smaller share of 11-13%, with little movement across the year.

The average age of bettors also varies by game.

- CS2 bettors averaged 31 years old in the fourth quarter of 2024 (Sharpr, 2024).

- Meanwhile, LoL bettors averaged 29 years old in the same period.

How To Interpret Esports Betting Statistics

Esports stats can seem quite daunting, but most reports use a small set of core figures. Once you understand what these numbers mean, it becomes much easier to read esports betting data.

Definition of Key Esports Betting Market Metrics

A lot of people mix up the terms betting revenue, market size, and handle. However, it helps to think of them as three separate ideas.

- Betting revenue: The money operators earn after they pay out winnings.

- Market size: In most reports, this also refers to revenue and shows how much money the industry brings in.

- Handle: the total amount of money wagered on esports events.

How To Interpret Esports Betting Market Projections

Growth figures are often based on different measurements, so it helps to look at what each term describes.

- Yearly change/year-on-year change: Shows how the market moved compared with the same period in the previous year.

- CAGR: Shows the average yearly growth across a longer period.

Essentially, yearly changes are short-term changes showing momentum, whereas longer projections like the CAGR help people see the wider direction of the market.

Understanding Data Sources

Esports betting statistics are gathered from different sources that track various aspects of the market, which is why the numbers can vary across reports.

The aim is to understand what each source focuses on exactly so you can build a clearer picture of how the market works.

Is Esports Betting Profitable?

The idea of profit in esports betting depends on which side of the market you’re looking at.

For Operators

- Esports betting odds have a built-in margin of profit for operators (called the “vig” or “juice”), giving them a small advantage on every bet.

- Many esports events also generate steady activity and help bookmakers spread risk across multiple bets.

- Basically, for operators, esports betting is designed to be profitable over time.

For Bettors

- Esports betting odds are inherently designed to favor the operator (usually, called the “house edge”), so bettors are likely to lose money over long periods of time.

- However, big wins are possible—it all depends on match outcomes.

- This makes esports betting more about entertainment than about long-term income.

What Are The Global Esports Betting Trends For 2025?

Several clear trends stand out.

Growth Shaped By Higher Overall Activity

The market continues to grow as more people place bets—and they do so at slightly higher values each time. Additionally, there are large events that drive betting to a peak during specific periods, which are then followed by quieter periods, thereby maintaining steady revenue.

Regions Developing In Their Own Way

The global market does not grow at the same pace everywhere, due to regulations, the strength of each fan base, and the level of establishment of the betting market in each area.

Few Games Drive Most Activity

Betting primarily focuses on a small group of titles with steady competition calendars, such as CS2 and LoL.

Growing Interest Among Younger Adults

Younger bettors continue to drive most of the activity, with Gen Z and Millennials comprising the majority of esports bets.

FAQs

How popular is esports betting in 2025?

Esports betting is extremely popular, with over 80 million people participating worldwide.

What is the global esports betting market size?

The global esports betting market size stands at around $2.8 billion in 2025.

Why is esports betting growing so quickly?

Understanding the growth trajectory of esports gambling comes down to a few steady patterns. More people are placing bets and spending slightly more each year. Major tournaments also create peaks in activity.

How do you analyze esports betting statistics correctly?

Start by viewing betting revenue and the betting handle to understand how much money operators are making and how much money people are betting on esports. Then, examine the yearly change and longer projections to see how activity is evolving over time.

What games drive the most esports betting revenue in 2025?

A small group of games leads the market. CS2 has the largest share, followed by LoL, Dota 2, VALORANT, and CoD.

References

- Global Esports Betting Monitor: H1 2025 (Sharpr.substack)

- What 2025 Revealed About Esports Betting for Operators (Odin.gg)

- Esports Betting Performance Drives Profit (DATA.BET)