SuperData Report Predicts Esports Revenue will Grow 26% by 2020

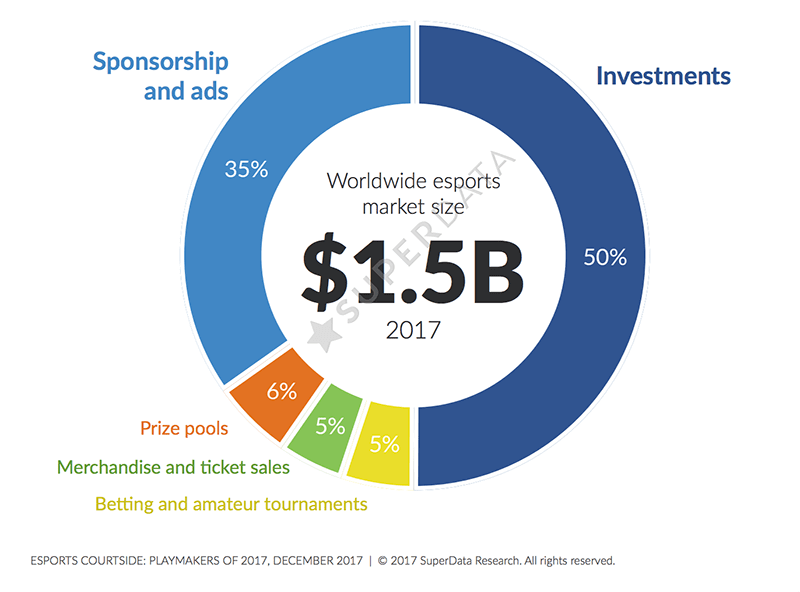

A recent report by SuperData has demonstrated a $1.5 billion revenue intake for the esports industry for 2017, with predictions anticipating continued growth over the next five years. Given the current popularity of esports, this rate of growth isn’t all that surprising, however, the numbers produced by SuperData reveal a significant trajectory.

When SuperData completed a market review of the industry back in 2016, the revenue of esports stood at $900 million for the year, with the prediction being that 2017 would see a revenue of $1.1 billion. As you can see from this new report, that prediction has been met and smashed by the increased popularity of esports activities.

The reason for this trajectory staying the course is said to be due to increased investment from third parties, alongside an increase in viewers, with this rise in viewership projected to grow annually by 12%. Taking this into account, the continued expansion of esports would be ample enough, but then SuperData has added the recent developments to League of Legends and Overwatch into their predictions. The franchising surrounding the new leagues, in particular, is anticipated to further add to esports revenue.

As you can see, the information utilized by SuperData has been taken from key competitors within the industry, notably that of Riot Games, Blizzard Entertainment, and Valve Corporation. However, it must be said that some of the metrics that SuperData have used in order to measure projected revenues, could be seen as debatable at best. An example of this is the prize pool of tournaments; some of the events are funded by the developers themselves, and so don’t accurately represent revenue. This isn’t the case for all competitions, but the fact still remains that some details are less than reliable.

What has surprised many, including ourselves, is how small the percentage of revenue is from betting and amateur tournaments. If you consider the coverage of most events, the betting scene is charged with energy, and so it seems odd that it should only produce 5% of the final $1.5 billion total.

In addition to these factors, SuperData also outlined the dominance of LoL over Dota 2, although both circuits pull an impressive player base, with LoL seeing approximately 84 million monthly players, while Dota 2 generates 10 million per month. Alongside their active participation, it was also noted that these gamers watched over 2.1 billion hours worth of content, from both Twitch and YouTube, between April and October. For those of you who are part of the esports community, you’ll know that Twitch has been a staple platform since the beginning, while YouTube is increasingly becoming a part of the scene. Nonetheless, as SuperData shows, Twitch still holds the majority of the viewership at 20%, while YouTube falls behind at 11%.

For most of you, the news of such growth will come as no surprise, seeing as the esports industry generates mass interest year after year.

However, what SuperData’s report has shown is that the growth is a lot more dramatic than we may have first thought and that the sustainability of the industry is fast increasing.

Source: Research company SuperData