Esports Stocks: Investing in Esports & Gaming Companies in 2025

This article covers the esports industry sector in the first half of 2025 and our selection of esports and gaming stocks with potential growth in the medium to long term.

Investing in stocks in general can be a very profitable activity over time, but it also carries the risk of losing the entire invested capital. Therefore, our advice is always to speak with investment experts registered in the respective countries’ professional registers or to discuss with your trusted banks.

Having said that, we cannot fail to notice the great potential of investing in the esports industry in general and the staggering growth of companies in the sector, their revenues, and prospects.

Market Status of Esports/Gaming Over the Years

In 2021, the esports industry revenues were estimated at around $950 million, with 2022 closing at about $1.3 billion. There are approximately 240 million enthusiasts worldwide, data that you can delve into from Videogames Europe Esports and the Entertainment Software Association (USA).

This industry is poised to continue growing in the coming years. The recent sponsorships of major companies in the sector in various sports are evident to all of us. For example, think of football, where the English Premier League or the Spanish La Liga and the Italian Serie A are filled with teams sponsored by gaming companies.

Inevitably, the esports industry moves hand in hand with sports and the expansion of video games. As evidence of the growing interest in the sector even by major players in the IT industry, we want to highlight 2 very important cases that occurred in the last months between 2023 and 2024:

- One of the world’s esports giants, Activision Blizzard, was acquired by Microsoft Corp. for the record sum of $68.7 billion. The acquisition was concluded in October 2023 and was the most expensive purchase in Microsoft’s history. It’s worth noting two things: first, as of the first half of 2024, Microsoft is the world’s largest capitalized company; second, Activision Blizzard was officially delisted from the stock exchange on October 13, 2023, and therefore cannot be purchased on the stock exchange anymore.

- One of the world’s largest technology companies, Nvidia, which deals with graphics processors for the video game market, has had record stock performances, over +30% in just the month of February 2024 and approximately +250% in the last 12 months, demonstrating the excitement around the sector.

Why Consider Investing in Esports and Gaming Industry

The gaming sector is experiencing strong growth worldwide, as are the revenues of its companies. Investments worth hundreds of billions of dollars have been made worldwide in this sector in recent years, and in the coming years, the fruits will be reaped.

One of the most important investments was made by Disney, which strengthened itself especially in gaming and invested $1.5 billion to purchase an equity stake in Epic Games.

“It’s our biggest foray ever into video games,” says Iger, who will collaborate with the Fortnite company to create new games and an entertainment universe where “playing, watching, shopping, and interacting with Disney, Pixar, Marvel, Star Wars, and Avatar content, characters, and stories.”

However, it is important to remember that one thing is the revenues of companies and another thing is the prices of companies listed on the stock exchange. Meaning that the stock prices of companies do not always exactly reflect the true value of the companies because there are other factors in the financial markets that affect the price, so once again, we urge caution.

The esports sector is relatively young, and there is not enough history for some evaluations. The companies that are part of it are all classified as “growth” and never “value”, precisely because of their characteristics, therefore potentially rapid growth and almost always without the distribution of a dividend. This raises the level of risk of your portfolio, and if you hold the stocks of these companies, we always recommend diversifying your portfolio with other types of more resilient and less volatile sectors such as consumer goods, energy, or utilities.

© Carl Scheffel | MSG Photos

Top 5 Most Interesting Gaming & Esports Stocks to Invest in this year

We have selected five stocks that present interesting situations on the market, at least in the first half of 2025. We chose these stocks by considering some key factors such as the size of the company (market capitalization) and the performance of the stock price in recent months. And obviously, we have not overlooked the future projects of these companies.

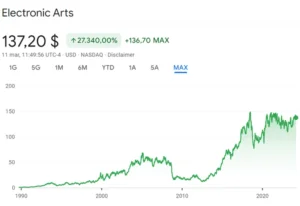

1. ELECTRONIC ARTS (EA)

Electronic Arts, Inc. is a California-based company that develops, markets, and distributes games. It’s listed on the NASDAQ, with a market capitalization of over $37 billion.

Historically, it has been a solid company to invest in. Looking at its balance sheet, it has more liquidity than debt, and it has raised its dividend for 4 consecutive years.

Revenues in recent quarters have continued to grow, albeit at a slower pace, and the company is adopting a restructuring plan to contain costs, including personnel costs.

The stock has performed over +26% in the last year, and we believe it can still perform well but only in the long term.

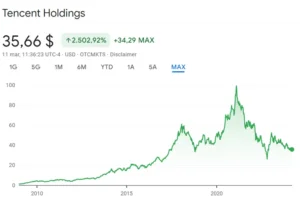

2. TENCENT (TCEHY)

Tencent Holdings, a Chinese holding company, is one of the largest tech companies in the world. First in the world by revenue in the video game industry the company is listed in Hong Kong, with a market capitalization of around $330 billion.

You have probably heard of WeChat, the Asian competitor to WhatsApp, as well as Fortnite, one of the most popular video games in the world. Well, both are owned by Tencent (to be precise, Fortnite is 40% owned).

The company’s revenue in recent months is declining after having experienced an explosion in sales in recent years, and the stock has also fallen. In just one year, the stock price has increased by about +20%. For these and other reasons, we consider Tencent an interesting investment possibility overall. For example, in a 5-year horizon, we believe it can perform well, but of course, there are risks.

When investing in China, it is always useful to remember that there are significant political risks to consider and this can make a difference.

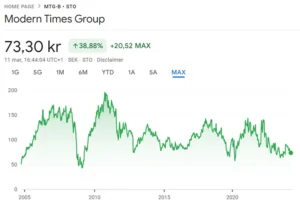

3. MODERN TIMES GROUP (MTG-b)

Modern Times Group is a Swedish company that manages TV channels and radio stations in Northern Europe, produces entertainment content, and distributes MTGx including esports. The company on the stock exchange appears very solid, with a market capitalization of just over $9 billion and quarterly revenues almost constant at over $1.5 billion.

The stock price has been stable in the last year but is traded considerably below the fair value. Again, the recommendation is the utmost caution, but in the long run, it has excellent chances of performing well.

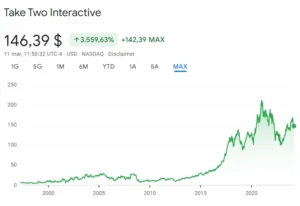

4. TAKE-TWO INTERACTIVE SOFTWARE, INC (TTWO)

A US company with offices in New York and Geneva, is an extraordinary giant of the video game industry. In 2022, they completed the acquisition of Zynga for $12.7 billion. With a market capitalization of over $25 billion, it is among the most active and interesting American companies in the video game landscape.

In the stock market in the last 12 months, it has achieved a performance of over +30%. Revenues are constantly increasing, and it can be a good long-term investment opportunity.

5. FLUTTER ENTERTAINMENT (FLTRF)

Finally, we could not fail to mention this global giant based in Ireland. Flutter Entertainment is only marginally involved in esports but is a global giant in the broad gaming and sports betting sector. It owns Paddy Power and Betfair as well as PokerStars and hundreds of startups worldwide in iGaming and gambling. Listed in London (FLTRF) and New York (FLUT), it has a market capitalization of over $37 billion. If it is true that the house always wins… why not buy the house?

What are Esports ETFs?

An Exchange Traded Fund (ETF) is a basket, a container of different company stocks that have something in common, such as the industrial sector or a geographical area.

The advantage of investing in an ETF is the spreading of risk among as many companies as contained within the fund. Basically, by investing in an ETF instead of in individual companies, you significantly lower the risk you take on, as it is distributed among different companies. An ETF has the sole purpose of replicating an underlying index, so when we look for an ETF, we should simply check that it has an adequate size, issued by a large international issuing company.

In the esports sector and more generally in the igaming sector, there are several ETFs that you can invest in to have equity exposure to the sector.

In this regard, after researching the current ETFs listed in 2025, we feel compelled to mention an interesting fund: the VanEck Video Gaming and eSports UCITS ETF.

It is listed on the London Stock Exchange with ISIN code: IE00BYWQWR46

The issuing company VanEck is an American investment management company that manages almost $80 billion in assets, so I consider it decidedly reliable.

As you can see, it is an accumulation ETF with a significantly contained annual expense ratio. As of March 2024, it has gained approximately 100% in 5 years and about 20% in 1 year. With the term accumulation “acc” or “c,” when it comes to ETFs, it means that the annual dividends, if any, distributed by the companies contained in the fund, are automatically reinvested by the ETF, thus causing the compounding effect so beloved by medium and long-term investors.

There are other ETFs on the market that invest in esports, but the one mentioned above is the only one that has attracted our attention and reflects our requirements for solidity, historical background, and the size of the fund.

Where and How to Buy Esports Stocks & ETFs

If you’re thinking about investing in esports stocks, you’ll first need to learn all you can about esports investing. You can make better decisions if you do your research on stock ownership, such as choosing a good broker to buy your shares on, market cap and float, along with key metrics for valuing a stock such as price to earnings.

It is important to learn how to judge if a stock’s current value is a good investment, or if it is currently overvalued compared to the company itself.

There are a number of ways to invest in esports or buy esports stocks. You can buy esports stocks directly or buy stocks of related industry companies. If you are really serious about investing in esports, or buying esports stocks, you might want to consider using a stockbroker or contacting an investment expert, one who already knows the industry well and can advise you. You can also use a brokerage that lets you manage your investments directly yourself.

How to invest in esports

Many people tend to buy stocks online from share dealing platforms. By heading to one of these sites you should be able to buy shares from any esports or gaming company listed on a stock exchange. Share dealing platforms cover the larger stock exchanges like the London Stock Exchange or New York Stock Exchange.

A stock brokerage is a company which is licenced to purchase and hold stocks on behalf of an individual investor. You have loads of choices here, with many online brokerages even operating with low fees. Check in your country which brokers give you access to the major and most important markets like the American exchanges, the London Stock Exchange, and the European trading platform Euronext. Just to give an example, there are also international platforms that operate in much of the world; the two largest are the American group Interactive Broker and the European DeGiro.

Meet the mind behind this article: Alessandro Attolino.Alessandro is an independent Investor and Trader, financial analyst, and affiliate partner of SIAT (Società Italiana di Analisi Tecnica, Italian Society of Technical Analysis), which is a member of IFTA (International Federation of Technical Analysts). He is also a Financial Trainer and Informant, author of the Italian podcast “Mercati, dividendi e caffè” (literally: “Markets, Dividends, and Coffee”) on air on all platforms. You can find him on Linkedin.

This content on esports stocks and ETFs is for informational purposes only, not investment advice. The esports market’s potential is highlighted for educational purposes. We advise consulting with financial experts before making investment decisions, as all investments carry risks.